6 Best Salon Accounting Software Options in 2024

The $48/month “Gold” plan adds waitlist management, liability waivers, and more. Users are immediately greeted by a beauty industry design that inspires confidence. What sets GlossGenius apart is how beautifully its financial tools integrate for a unified salon workflow.

Travel expenses for self-employed hairdressers

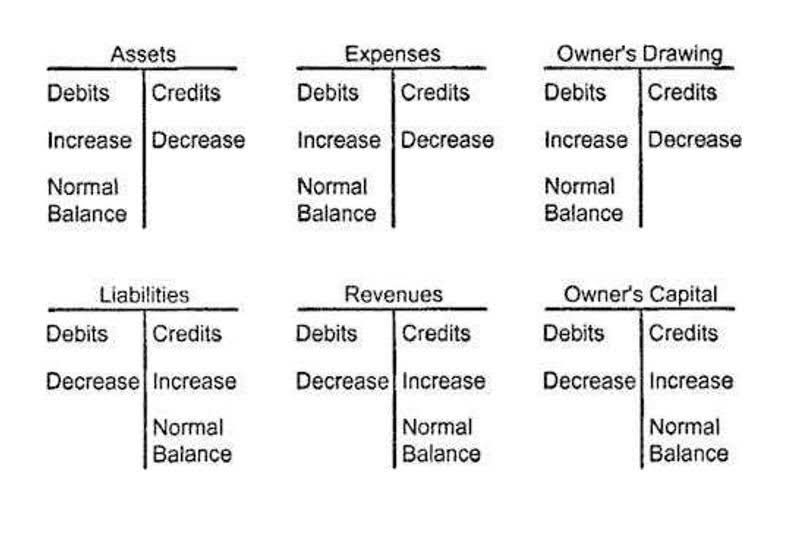

Double-entry bookkeeping, a widely used method, ensures accurate recording of both income and expenses, providing a comprehensive view of your salon’s financial status. Yes, salons and beauty spas should consider using accounting software to help manage their finances. Accounting software will help make payments, track expenses, and keep track of inventory easier by automating the processes. It can also provide insights into the financial health of the business and help to identify areas that need improvement. Keeping accurate records is crucial for any business, and salons are no exception. Reliable financial records help to identify profitable service and product lines, curb overspending, salon bookkeeping and make informed decisions regarding future investments.

Open a business current account

If your salon invests in assets like stocks or bonds, it’s essential to manage these transactions carefully. Consult with a financial advisor to ensure your investments align with your business Bookkeeping for Chiropractors goals. Clear financial records help you track performance, identify growth opportunities, and scale your business effectively. Some self-employed hairdressers rent a chair in a beauty salon to avoid having a salon at home.

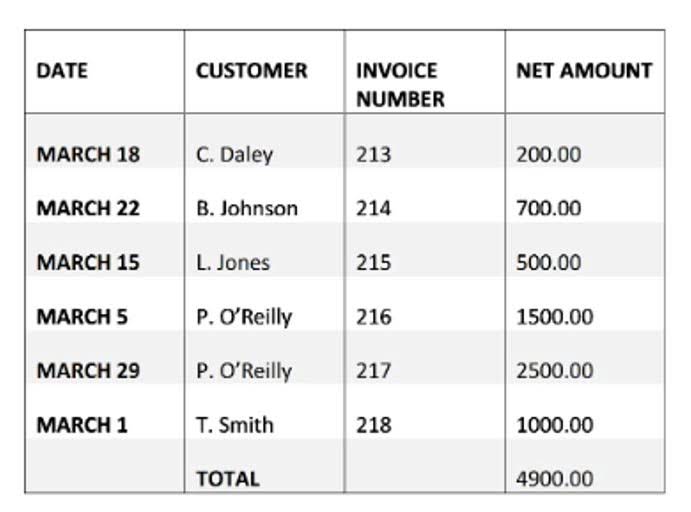

Accounts payable and receivable

- You can always turn to professional help – just like customers trust you with their locks – and get advice from an accountant who knows salon specifics inside out.

- Accounting then analyses your bookkeeping data to show you how your business is doing financially.

- Plus, learn about financial reports that actually tell you something useful about how well things are going (or not).

- You can also claim back the cost of any PPE or other protective items you need to do your job.

- Sign up for your free trial today to grow your salon business and manage your accounting the easy way.

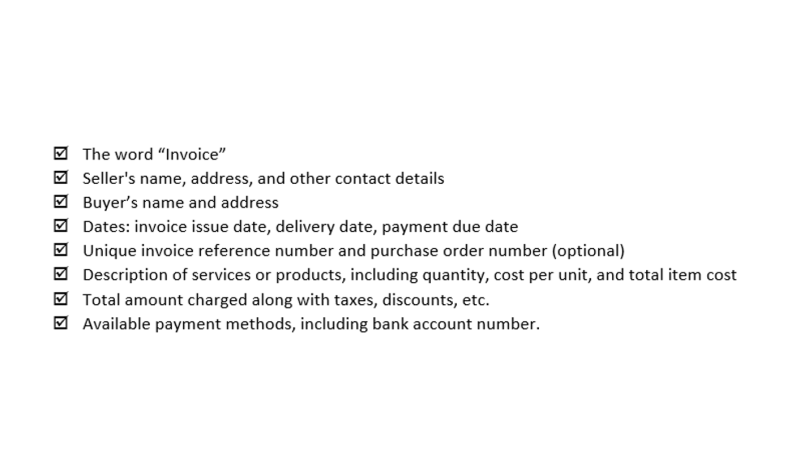

Integrate different payment methods, such as cash, credit, and debit cards, and generate detailed invoices that clearly state the services and products purchased. Ensure all transactions are recorded under the correct accounts to assist in generating valuable financial reports. Our detailed brochure provides insights into how Remote Books Online can help you maintain accurate bookkeeping, stay tax-ready, and make informed financial decisions. Discover how our tailored bookkeeping services can support your business growth and simplify bookkeeping your financial management.

- You can set yourself up as a sole trader, limited company, or a partnership.

- To maximize productivity, choose programs that offer abundant 3rd-party app integrations.

- Integrating your accounting software with your salon management tools can help you streamline your overall management process.

- Additionally, the software should be flexible enough to adjust to your business needs and processes.

- This is where the importance of your chart of accounts comes into play.

What expenses can you claim as a childminder?

- In this article, we will explore the 5+ best accounting software options for salons and beauty spas, so that you can find the perfect solution for your business.

- Proper tracking of transfers helps maintain liquidity and prevent overdraft fees.

- Many solutions offer free trials, so you can test them out risk-free.

- Let your creativity and client care sparkle by modernizing management.

- It provides insights into cash flow, expenses, and profits, enabling owners to identify trends and make informed choices.

- We’re also tackling how to keep track of all those different ways money comes into your salon because let’s face it – every penny counts.

Once you get a handle on these numbers, they’ll start to sing sweet tales of your salon’s fiscal health – or give you the nudge needed for some monetary tune-ups. If bookkeeping for hair stylist managing salon inventory were a dance, it would be the tango – intricate, precise, and needing just the right balance. You’ve got products flying off the shelves one minute and collecting dust the next.

Additional features like the 24/7 AI chatbot and marketing automation make Mindbody a powerful all-in-one solution for beauty businesses. The software should be able to generate reports such as income statements, balance sheets, and cash flow statements. These reports will help you track your revenue, expenses, and cash flow and make informed decisions about your business.